What is Greenlight?

Greenlight is a fintech organization dispatched in 2014 by fellow benefactors Tim Sheehan and Johnson Cook. The organization is situated in Atlanta, Georgia and has multiple million clients.

Greenlight professes to assist families with bringing up monetarily brilliant children by offering a check card that guardians can use to pay stipends and screen spending. Greenlight offers contributing freedoms too. With the Greenlight card, kids get the opportunity to find out with regards to spending and saving, and different administrations presented by Greenlight can assist kids with learning the rudiments of contributing.

How does Greenlight work?

The Greenlight check card for youngsters is exactly what it seems like — a charge card intended for kids to utilize. As a parent, you can stack the charge card utilizing the Greenlight application, and your children then, at that point, approach reserves. You have the choice to make moves physically or set up week after week programmed moves. Guardians additionally set the terms for adding cash, which could incorporate requiring tasks, getting passing marks, or simply giving a recompense. You may likewise decide to add cash to the card for crisis purposes.

Guardians and children both gain admittance to the Greenlight application, yet they see distinctive data when they sign in. As a parent, you can perceive what’s new with your youngster’s record, including checking balances and seeing buys. In the case of contributing is incorporated, you can support each exchange. At the point when your children sign in, they can see their equilibriums and put forward objectives, just as learn significant examples. The thought is for them to have the option to find out with regards to monetary administration with a bunch of instruments in the portable application.

Greenlight card spending and saving adjusts are guaranteed by the Federal Deposit Insurance Corp. (FDIC) up to the furthest reaches of $250,000. On the contributing side, Greenlight is enlisted with the U.S. Protections and Exchange Commission (SEC) and is additionally an individual from the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC). So in spite of the fact that there’s no assurance against choices you and your children bring in with regards to cash, you are ensured if the Greenlight organization comes up short.

Features

Parental Controls

- Monitor spending

- Turn ATM access on/off

- Activate or deactivate the card

- Receive exchange alarms

- Set store-explicit consents if your kid ought to just go through cash at explicit areas

Adding Money

- Parents can store cash straightforwardly from their financial records

- Teens with a task can set up direct store

- Parents can set up repeating recompense installments as well as once installments for tasks

Errand Management

- Assign week after week or once tasks

- Set task due dates and prize sums

- Add task portrayals for clearness

Reserve funds Tools

- Round-up moves on charge buys into your kid’s bank account

- Add parent-paid “premium” for account adjusts to instruct about accumulate revenue

- Set investment funds objectives in the application

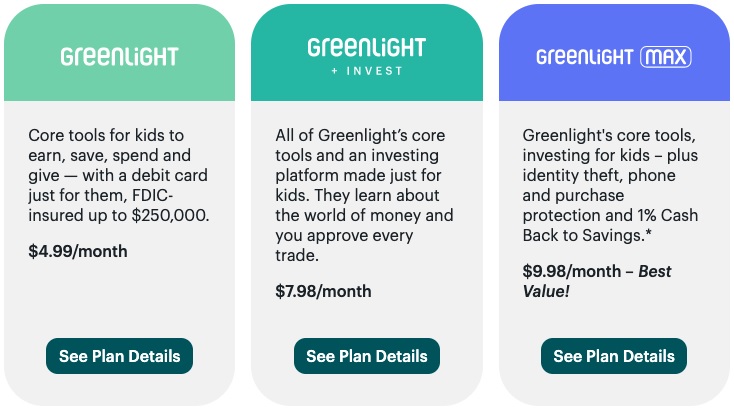

Greenlight plans

This is the essential arrangement from Greenlight. It costs $4.99 each month and incorporates the Greenlight check card, which you can get for up to five children. You likewise gain admittance to the Greenlight application, which offers two distinct encounters for guardians and children. This arrangement additionally incorporates apparatuses that permit children to see their spending and saving adjusts, just as defined their own objectives. They can likewise follow things like recompense and alternate methods of procuring.

Parental controls are likewise remembered for the Greenlight plan. Guardians can decide to add assets to the Greenlight card for their children, just as drawn spending lines, store-level controls, and screen what’s happening in their children’s records.

The Greenlight essential arrangement is the most economical choice and can function admirably for families with more youthful children who are simply finding out with regards to cash the executives. It very well may be a valuable instrument to assist them with finding out with regards to how to oversee cash and put out investment funds objectives. In case you’re keen on assisting your children with creating fundamental monetary proficiency, this arrangement is probably going to be satisfactory.

Greenlight + Invest

Other than every one of the apparatuses accessible with the Greenlight plan, Greenlight Invest adds a component of contributing. Children can start finding out with regards to putting away cash with just $1 on a stage intended for them. There are no exchanging charges included and guardians need to support each exchange from their parent account.

For those keen on assisting their kids with picking up contributing and the significance of getting everything rolling, this can be one way of doing it. Greenlight assists kids with purchasing partial offers, furnishing them with a way of putting resources into their cherished organizations. On the off chance that your children are mature enough to find out with regards to contributing and begin settling on those decisions, this can be a decent arrangement for your family, however it accompanies an expense of $7.98 each month.

Greenlight Max

On top of having a Greenlight check card for youngsters, just as admittance to contributing and other monetary administration learning assets, Greenlight Max accompanies extra advantages. To begin with, you get need client assistance for your issues. Be that as it may, different advantages include:

- Identity burglary security: Identity observing and alarms that can assist you with keeping steady over personality related dangers.

- Cell telephone security: If a mobile phone bought with Greenlight is harmed or lost, it very well may be ensured for up to five children.

- Purchase security: Items that are harmed or taken, and paid for with Greenlight, can be supplanted or fixed.

For $9.98 each month, this arrangement could be useful for families that need comprehensive security on top of admittance to monetary assets and apparatuses.

Pros and Cons

Pros:

- Excellent parental controls

- Teaching kids the connection among work and rewards

- Top-score instructive and reserve funds apparatuses

Cons:

- Relatively high charges

- Can’t store cash (should move carefully)

- Difficult to close a record (see underneath)

Conclusion

For guardians wanting to assist their children with learning cash the executives, the Greenlight card can be a significant apparatus. There are various assets, and it makes it simple so that you could perceive how your kids are doing their cash anytime.

Nonetheless, Greenlight costs cash. There are alternate ways of giving your youngster admittance to a customary or pre-loaded check card, just as find out with regards to contributing, without paying expenses. Large numbers of the best deal shared services with kids, and these permit you access and control — however seeing everything most likely isn’t generally so straightforward as what you’d get with Greenlight. You need to conclude what works best with your own inclinations.

Assuming you need everything in one spot and in a manner that is not difficult to see and oversee, Greenlight may merit the expense.