Soldo Overview

Soldo is a financial technology company that offers a comprehensive expense management platform for businesses. This platform is designed to simplify and streamline the process of handling company expenses and financial transactions. Here’s an overview of key aspects of Soldo:

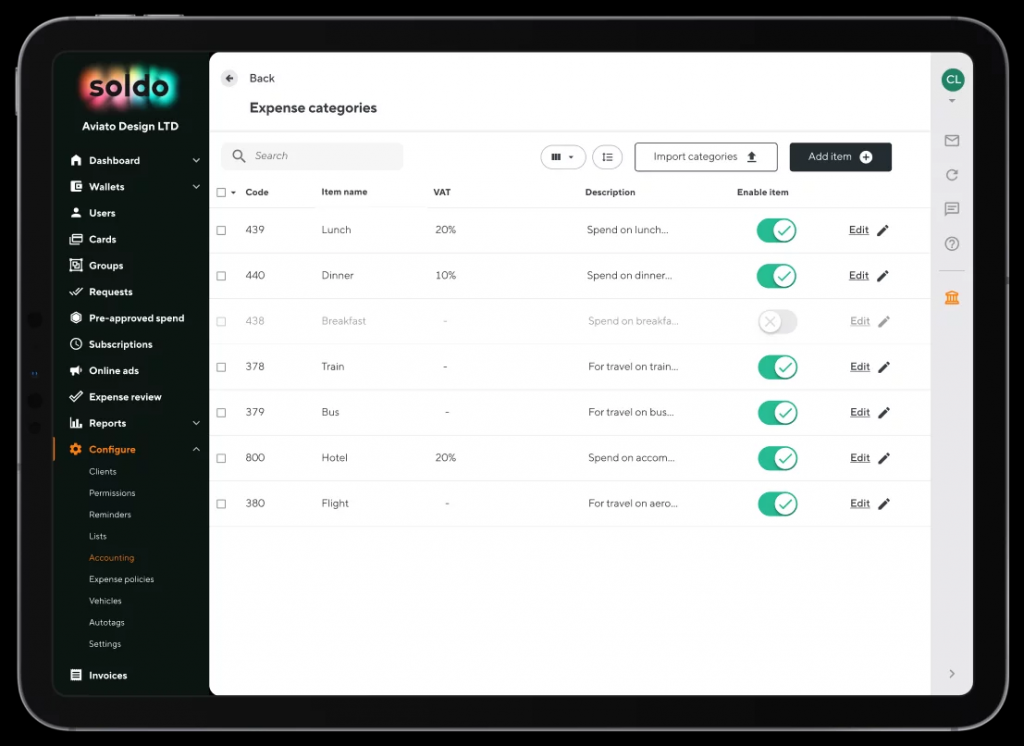

- Expense Management: Soldo provides businesses with a centralized platform to manage and monitor expenses effectively. It offers tools for tracking and controlling company spending in real-time.

- Prepaid Cards: One of Soldo’s primary features is the issuance of prepaid debit cards. These cards can be distributed to employees and are linked to the company’s Soldo account. Businesses can set spending limits and restrictions on these cards.

- Expense Tracking: All transactions made using Soldo prepaid cards are automatically recorded and categorized within the platform. This makes it easy for both employees and administrators to keep track of expenses.

- Expense Approval Workflows: Soldo allows businesses to establish customized approval workflows for expense requests. This ensures that expenses are properly reviewed and approved before funds are allocated, enhancing financial control.

- Integration: Soldo integrates seamlessly with various accounting software and financial tools. This integration simplifies the process of syncing expense data with the company’s accounting systems.

- Reporting and Analytics: Soldo offers robust reporting and analytics tools, enabling businesses to gain valuable insights into their spending patterns. These insights help in making informed financial decisions and optimizing expenses.

- Security: Soldo places a strong emphasis on security. It offers features such as transaction alerts and the ability to lock or unlock cards instantly in case of loss or theft, ensuring the safety of company funds.

- Multi-Currency Support: For businesses operating globally, Soldo supports multiple currencies. This feature makes it suitable for companies with international operations.

Soldo Quality

- User-Friendly Interface: Soldo offers an intuitive and user-friendly interface, making it easy for both employees and administrators to navigate and use the platform effectively. This simplicity enhances user adoption and overall satisfaction.

- Comprehensive Reporting: Soldo’s robust reporting and analytics tools provide detailed insights into spending patterns, enabling businesses to make data-driven decisions and optimize their financial strategies.

- Integration Capabilities: Soldo’s ability to seamlessly integrate with various accounting and financial software systems enhances its value to businesses. This integration streamlines financial data management.

- Multi-Currency Support: For businesses operating internationally, Soldo’s support for multiple currencies is a valuable feature. It facilitates expense management in diverse markets.

- Scalability: Soldo’s platform is scalable, making it suitable for businesses of various sizes, from small startups to large enterprises.

- Reliability: Soldo has a track record of reliable service, ensuring that businesses can depend on the platform for their day-to-day financial operations.

Soldo Customer Services

- Responsive Support Team: Soldo maintains a dedicated and responsive customer support team that is readily available to assist users with their inquiries, issues, or concerns. This team helps users navigate the platform and resolve any technical or account-related issues promptly.

- User Resources: Soldo provides users with a variety of resources such as user guides, FAQs, and tutorials. These resources are designed to empower users to independently solve common issues and make the most of Soldo’s features.

- Customized Support: Depending on the needs and requirements of the business, Soldo may offer customized support solutions. This can include tailored training sessions, dedicated account managers, and personalized assistance to meet specific business needs.

- Continuous Improvement: Soldo is committed to continuously improving its platform and services based on user feedback. This feedback loop allows Soldo to address issues, implement enhancements, and adapt to evolving user needs.

Soldo Benefits, Advantages And Features

Benefits and Advantages:

- Real-Time Expense Tracking: Soldo provides real-time updates on transactions, allowing businesses to monitor spending as it happens, reducing the risk of overspending or fraudulent activities.

- Enhanced Financial Control: Customizable approval workflows and spending limits enable businesses to exercise greater control over expenses, reducing unauthorized spending.

- Improved Visibility: Soldo offers comprehensive reporting and analytics tools, providing insights into spending patterns, which helps businesses make informed financial decisions.

- Multi-Currency Support: Soldo supports multiple currencies, making it suitable for businesses with international operations or employees who need to make transactions in different currencies.

- Increased Security: Soldo prioritizes security with features like transaction alerts and card locking/unlocking, safeguarding company funds and data.

Key Features:

- Prepaid Cards: Soldo offers prepaid debit cards that can be issued to employees for business expenses. Administrators can set spending limits and restrictions on these cards.

- Customizable Approval Workflows: Businesses can define their own approval processes for expense requests, ensuring that expenditures align with company policies.

- Onboarding and Training: Soldo typically offers onboarding materials, webinars, and training sessions to help users get started and maximize the platform’s potential.

- Customer Support: A responsive customer support team is available to assist users with inquiries, issues, or concerns.

Experts Of Soldo

- Easy expense tracking: Soldo provides users with a simple and intuitive interface for tracking expenses, making it easier to monitor and control spending.

- Real-time transaction notifications: Users receive instant notifications on their mobile devices whenever a transaction is made using their Soldo card, allowing for quick oversight of spending.

- Enhanced financial control: Soldo enables businesses to set spending limits and restrictions on the cards issued to employees, improving financial management and reducing the risk of overspending.

- Streamlined reimbursement process: With Soldo, employees can easily submit expense claims directly through the app or web portal, simplifying the reimbursement process for both employees and finance teams.

Soldo Conclusion

In conclusion, Soldo is a reputable and effective expense management platform that provides businesses with the tools they need to streamline their financial processes, control expenses, and gain valuable insights into their spending patterns. With its user-friendly interface, real-time expense tracking, and robust reporting capabilities, Soldo offers numerous benefits, including enhanced financial control, time and cost savings, and increased security.

Soldo’s prepaid cards, customizable approval workflows, and integration capabilities make it a versatile solution suitable for businesses of all sizes and industries. Its commitment to customer support and ongoing improvement ensures a positive user experience and allows businesses to adapt and grow with confidence.