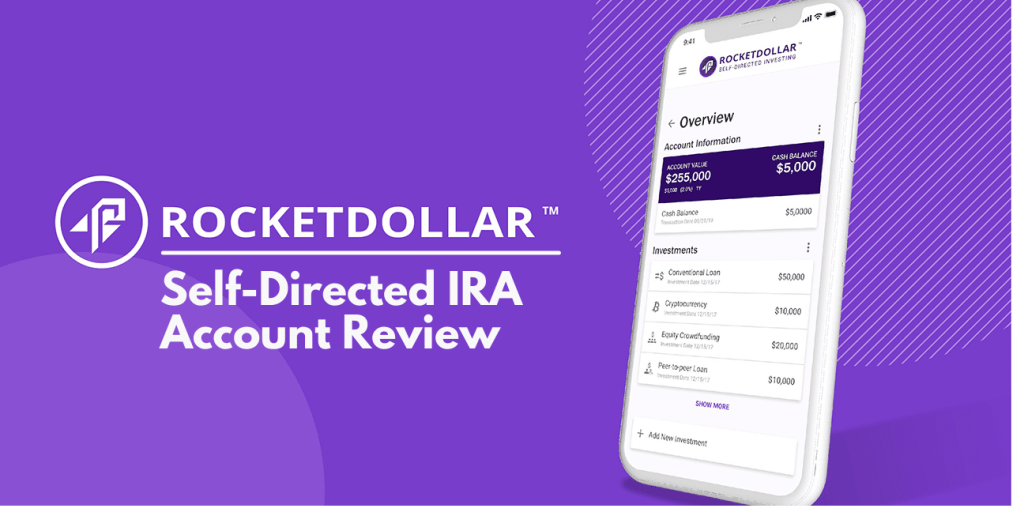

Rocket Dollar Overview

Rocket Dollar is a financial technology company that offers self-directed retirement account solutions. Their platform enables individuals to diversify their retirement investments by providing access to a wide range of alternative assets. With Rocket Dollar, users can invest in real estate, private equity, cryptocurrencies, and more.

Traditional retirement accounts, like IRAs and 401(k)s, often limit investment options to traditional assets such as stocks and bonds. However, Rocket Dollar breaks these barriers by allowing individuals to invest their retirement funds in alternative assets that align with their interests and goals.

To get started, users establish a self-directed IRA or Solo 401(k) through Rocket Dollar. They can then transfer funds from their existing retirement accounts into their Rocket Dollar account. Once the funds are available, users can explore and invest in a variety of alternative assets directly through the platform.

Rocket Dollar provides a user-friendly interface that simplifies investment management and ensures compliance with IRS regulations. Users can track the performance of their investments and access educational resources to make informed decisions.

How To Use Rocket Dollar?

To use Rocket Dollar, follow these general steps:

- Sign up: Visit the Rocket Dollar website and create an account by providing the necessary information.

- Choose an account type: Select the type of self-directed retirement account that suits your needs, such as a self-directed IRA or Solo 401(k). Consider factors like eligibility, contribution limits, and your specific retirement goals.

- Select investments: Once your account is funded, explore the investment options available on the Rocket Dollar platform. You can choose from a variety of alternative assets, including real estate, private equity, precious metals, cryptocurrencies, and more. Conduct thorough research and consider your risk tolerance and investment objectives when selecting investments.

- Make investments: After deciding on the investments you want to pursue, use the Rocket Dollar platform to initiate the investment transactions. Follow the instructions provided by Rocket Dollar to complete the necessary paperwork and ensure compliance with IRS regulations.

- Manage and monitor: Keep track of your investments and their performance through the Rocket Dollar platform. Utilize the provided tools and resources to stay informed about your portfolio and make any necessary adjustments.

Rocket Dollar Customer Services

- Educational resources: Rocket Dollar provides educational materials to help users understand self-directed investing and alternative asset classes. These resources may include articles, guides, webinars, and FAQs. They aim to empower users with knowledge to make informed investment decisions.

- Account management: Rocket Dollar offers account management tools and features through their platform. Users can access their account information, monitor investments, track performance, and make updates or changes as needed. The platform is designed to provide a user-friendly interface for managing and organizing retirement investments.

- Compliance assistance: Rocket Dollar helps users navigate the compliance requirements associated with self-directed retirement accounts. They provide guidance on IRS rules and regulations to ensure users stay compliant with the applicable guidelines.

Rocket Dollar Benefits, Advantages And Features

- Diversification: Rocket Dollar allows users to diversify their retirement investments beyond traditional assets like stocks and bonds. Users can invest in a wide range of alternative assets, such as real estate, private equity, precious metals, cryptocurrencies, and more. This diversification can potentially enhance portfolio performance and mitigate risk.

- Flexibility and Control: With Rocket Dollar, users have more control over their retirement investments. They can choose the specific assets they want to invest in, aligning with their interests, values, and investment strategies. This flexibility enables individuals to have a more active role in managing their retirement savings.

- Tax Advantages: Rocket Dollar maintains the tax advantages of traditional retirement accounts. Users can enjoy tax-deferred or tax-free growth on their investments, depending on the type of account they choose (e.g., self-directed IRA or Solo 401(k)). This can provide potential tax benefits and help individuals maximize their retirement savings.

- Self-Directed IRA and Solo 401(k) Options: Rocket Dollar offers both self-directed IRA and Solo 401(k) account options. Self-directed IRAs are suitable for individuals who don’t have a company-sponsored retirement plan, while Solo 401(k)s are designed for self-employed individuals and small business owners. These account options cater to different needs and circumstances.

- Compliance Support: Rocket Dollar assists users in navigating the IRS regulations and compliance requirements associated with self-directed retirement accounts. They provide guidance and resources to help users stay compliant with the applicable rules and regulations.

- Educational Resources: Rocket Dollar offers educational materials, including articles, guides, webinars, and FAQs, to educate users about self-directed investing and alternative asset classes. These resources aim to empower users with knowledge and information to make informed investment decisions.

- Customer Support: Rocket Dollar has a customer support team available to assist users with inquiries, account-related questions, and technical support. Users can reach out to the customer support team via email or phone for assistance.

Experts Of Rocket Dollar

- Rocket Dollar offers a self-directed retirement account, giving investors more control over their investment choices.

- It provides a user-friendly platform with easy-to-follow instructions for setting up and managing the account.

- Rocket Dollar allows for investing in alternative assets like real estate and private equity, which may offer higher potential returns.

- Rocket Dollar provides educational resources and customer support to assist investors in making informed decisions.

Rocket Dollar Conclusion

In conclusion, Rocket Dollar is a financial technology company that offers self-directed retirement account solutions, enabling individuals to invest in alternative assets beyond traditional options. By providing access to a wide range of investment opportunities, Rocket Dollar aims to empower users to diversify their retirement portfolios, exercise greater control, and potentially enhance their long-term financial outcomes.

Through their user-friendly platform, Rocket Dollar facilitates the establishment of self-directed IRAs and Solo 401(k)s. Users can transfer funds from existing retirement accounts and invest in alternative assets such as real estate, private equity, cryptocurrencies, and more. The platform also offers tools for investment management, performance tracking, and compliance support.

By leveraging Rocket Dollar’s services, individuals can benefit from diversification, flexibility, and potential tax advantages while maintaining the tax-advantaged status of their retirement accounts. The educational resources provided by Rocket Dollar further equip users with knowledge and insights to make informed investment decisions.