Quicken

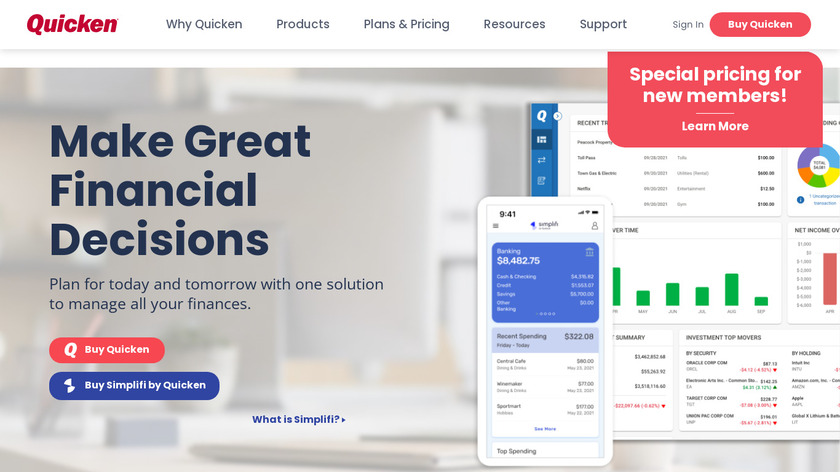

Quicken, a personal finance management software. Quicken is designed to help individuals and households manage their finances, track expenses, budget effectively, and plan for the future. Quicken offers a range of features and tools to assist users in organizing their financial information and making informed decisions about their money.

What Is Quicken?

Quicken is a popular personal finance management software developed by Quicken Inc. It is designed to help individuals and households effectively manage their finances, track expenses, create budgets, and plan for their financial goals. Quicken provides users with a comprehensive platform to organize and monitor their financial information. Users can connect their bank accounts, credit cards, investment portfolios, loans, and other financial accounts to Quicken, allowing them to view and track their transactions, balances, and overall financial health in one centralized location.

With Quicken, users can create budgets based on their income and expenses, categorize transactions, and set spending limits. The software offers tools to help users stay on track with their budgeting goals, including alerts and reports that provide insights into their financial habits and trends. Quicken helps users manage their bills and payments. It provides reminders for upcoming bills, tracks due dates, and enables users to schedule and track their bill payments. This feature helps users stay organized, avoid late fees, and maintain a clear picture of their financial obligations. Quicken also offers investment tracking capabilities, allowing users to monitor the performance of their investment portfolios. Users can track stocks, mutual funds, and other investments, analyze their investment strategy, and gain insights into their overall financial portfolio Quicken is a comprehensive personal finance management software that offers a range of features and tools to help individuals and households effectively manage their finances, track expenses, create budgets, plan for the future, and make informed financial decisions.

How To Use Quicken

Using Quicken is a straightforward process that involves a few key steps. Here’s a general guide on how to use Quicken:

- Install and Set Up Quicken: Begin by installing the Quicken software on your computer. Follow the provided instructions for installation and launch the program. During the initial setup, you’ll be prompted to create a Quicken ID and link your financial accounts.

- Connect Financial Accounts: Quicken allows you to connect your bank accounts, credit cards, investment portfolios, loans, and other financial accounts. To do this, select the “Add Account” or “Link Account” option within Quicken and follow the prompts to provide the necessary login credentials for each account. Quicken will securely download your transaction history and account balances.

- Categorize Transactions: Once your accounts are connected, Quicken will start importing your transaction history. Review and categorize each transaction to accurately reflect your income and expenses. Quicken provides suggested categories, but you can also create custom categories that align with your specific financial needs.

- Create a Budget: Quicken offers budgeting tools to help you track and manage your spending. Set up your budget by defining spending categories and allocating budget amounts for each category. Quicken can automatically track your spending against your budget and provide alerts when you approach or exceed your spending limits.

- Track Bills and Payments: Use Quicken’s bill management features to track and schedule your upcoming bills and payments. Set reminders for due dates, enter recurring bills, and record payments made. This helps you stay organized and avoid late fees by ensuring timely bill payments.

- Monitor Investments: If you have investment portfolios, use Quicken to track and analyze their performance. Add your investment accounts to Quicken, and it will automatically download transaction details and update portfolio values. Monitor investment performance, view historical data, and generate reports to gain insights into your investments.

- Generate Reports: Quicken provides a range of reports that offer valuable financial insights. Generate reports on income and expenses, net worth, investment performance, and more. These reports can help you understand your financial situation, track progress toward your goals, and make informed financial decisions.

- Utilize Quicken Mobile App: Quicken offers mobile apps for iOS and Android devices. Download the app, log in with your Quicken ID, and sync your data. The mobile app allows you to access your financial information on the go, enter transactions, check account balances, and stay connected with your financial data.

Quicken Customer Services

Quicken offers a range of services and features to help individuals effectively manage their personal finances. Here are some key services provided by Quicken:

- Financial Tracking: Quicken allows users to connect and aggregate their financial accounts, including bank accounts, credit cards, investment portfolios, loans, and more. It provides a centralized platform to track and monitor transactions, balances, and overall financial health.

- Budgeting and Planning: Quicken’s budgeting tools enable users to create and manage budgets based on their income and expenses. Users can categorize their transactions, set spending limits, and receive alerts and reports to help them stay on track with their budgeting goals. Quicken also offers tools for forecasting future expenses and planning for major financial events.

- Tax Planning: Quicken assists users with tax planning by tracking deductible expenses, organizing tax-related documents, and providing reports that can be helpful during tax preparation. This feature simplifies the tax filing process and ensures users are well-prepared for tax season.

Benefits, Features And Advantages Of Quicken

Quicken offers numerous benefits, features, and advantages that make it a valuable tool for managing personal finances. Here are some key aspects:

- Comprehensive Financial Tracking: Quicken allows users to aggregate and track their financial accounts in one place, providing a comprehensive overview of their financial health. Users can monitor transactions, account balances, and investments, helping them stay organized and informed about their finances.

- Efficient Budgeting and Planning: Quicken’s budgeting tools enable users to create personalized budgets based on their income and expenses. Users can categorize transactions, set spending limits, and receive alerts and reports to track their progress and make informed financial decisions. This feature helps users gain control over their finances and work towards their financial goals.

- Streamlined Bill Management: Quicken simplifies bill management by providing reminders for upcoming bills, due dates, and payment scheduling. Users can track and record bill payments, ensuring timely payments and avoiding late fees. This feature helps users stay organized and maintain a clear overview of their financial obligations.

- Investment Tracking and Analysis: Quicken allows users to monitor their investment portfolios and analyze their performance. Users can track stocks, mutual funds, and other investments, view historical data, and generate reports. This feature helps users make informed investment decisions and optimize their investment strategies.

- Convenient Mobile App: Quicken’s mobile app allows users to access their financial information on the go. Users can enter transactions, check account balances, view reports, and manage their finances from their iOS or Android devices. The mobile app provides flexibility and convenience, ensuring users stay connected to their financial data anytime, anywhere.

:max_bytes(150000):strip_icc()/GettyImages-1331485921-1946d0d50b7b48cb8929f15da0e93090.jpg)

Experts Of Quicken

- Quicken provides comprehensive financial tracking and analysis, helping users gain better control over their personal finances.

- The software offers a wide range of features, including budgeting, bill payment reminders, investment tracking, and tax planning tools.

- Users can easily link their bank accounts, credit cards, and other financial institutions to Quicken for automatic transaction updates and real-time balance monitoring.

Quicken Conclusion

In conclusion, Quicken is a powerful personal finance management software that offers a range of benefits and features to help individuals effectively manage their finances. With its comprehensive financial tracking, efficient budgeting tools, streamlined bill management, investment tracking and analysis capabilities, tax planning support, insightful reporting, convenient mobile app, and data security measures, Quicken provides users with the tools they need to stay organized, make informed financial decisions, and work towards their financial goals.

Quicken’s ability to aggregate and track financial accounts in one place gives users a comprehensive overview of their financial health, making it easier to monitor transactions, account balances, and investments. The budgeting tools help users create personalized budgets, set spending limits, and receive alerts and reports to stay on track with their financial goals. The bill management feature simplifies the process of tracking and scheduling bill payments, avoiding late fees and keeping users organized. Quicken empowers individuals to take control of their personal finances, make informed decisions, and work towards their financial goals effectively. Whether it’s tracking transactions, budgeting, managing bills, analyzing investments, planning taxes, generating reports, or accessing financial information on the go, Quicken provides the tools and features needed for successful financial management.